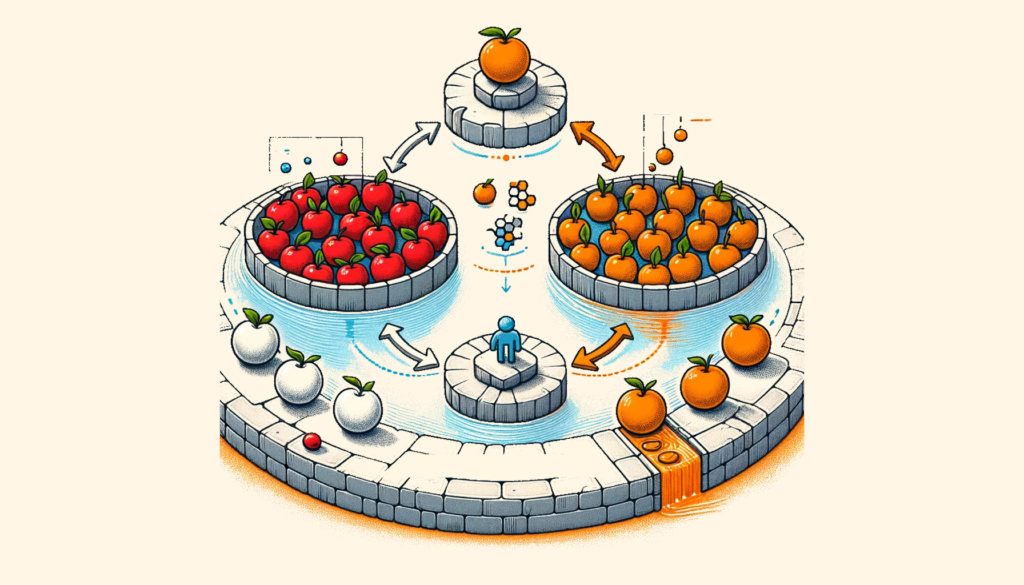

XRP’s Automated Market Maker (AMM) is like a digital marketplace on the XRP Ledger, allowing people to swap different assets automatically. Imagine if you had apples and wanted oranges; the AMM acts as a smart system that lets you make that swap based on set rules, without needing a direct person-to-person exchange. It uses pools of two assets (like apples and oranges) and adjusts prices based on supply and demand.

What is XRP’s AMM, in very simple terms?

XRP‘s AMM has everyone talking. Wondering what an AMM is, using simple terms like apples and oranges? Check out the summary below for a clear overview. Then, when you’re ready for more, dive into the official documentation from Ripple itself.

XRP’s Automated Market Maker (AMM) is like a digital marketplace on the XRP Ledger, allowing people to swap different assets automatically.

Imagine if you had apples and wanted oranges; the AMM acts as a smart system that lets you make that swap based on set rules, without needing a direct person-to-person exchange.

It uses pools of two assets (like apples and oranges) and adjusts prices based on supply and demand. For example, if lots of people want oranges, the system makes oranges slightly more “expensive” in terms of apples.

Users who supply these assets to the system, known as liquidity providers, get special tokens as a thank you, which they can use to get back their share of assets or even have a say in how the system runs.

Now let’s swap the apples and oranges example with a real AMM example. Imagine there is an AMM with 7 ETH and 7 USD, and then someone exchanged 2.14 USD for 1 ETH. The pool now has 6 ETH and 8.14 USD in it.

XRP’s Automated Market Maker (AMM) functions as a virtual marketplace within the XRP Ledger, enabling automated asset exchanges based on predetermined rules. This system maintains pools for pairs of assets (e.g., ETH and USD, XRP and BTC, or apples and oranges in our simplified example), adjusting their exchange rates according to current supply and demand.

If one asset becomes more sought after, the AMM increases their “price”. This dynamic pricing mechanism ensures that trades are balanced and fair, reflecting the real-time value each asset holds in the market.

Liquidity providers, who contribute assets to these pools, are crucial to the AMM’s operation. By supplying apples, oranges, or both to the pool, they enable others to make swaps. In return, these providers receive special tokens representing their stake in the pool.

These tokens are not only redeemable for their share of the pool’s assets, including any trading fees collected, but also grant them voting rights on certain decisions about the AMM, such as fee adjustments. This system rewards providers for their contributions while giving them a say in its governance.

Consider a scenario where you’re a liquidity provider who initially contributes an equal value of apples and oranges to the pool. If a surge of users wants to trade their apples for oranges, reducing the pool’s orange supply, the value of oranges in terms of apples increases.

As a provider, you earn a portion of the trading fees, and your tokens now represent a more valuable stake, given the increased demand for oranges. This model encourages a self-balancing marketplace, where assets’ values adjust according to their availability and demand, benefiting both traders and liquidity providers.

To wrap it up, XRP’s AMM is like a smart system that lets people swap different things, such as apples for oranges, automatically on the XRP Ledger. People who help by adding apples or oranges to the system get special tokens as a thank you. These tokens can be used to get their fruits back, earn some extra from fees, or help decide how the system works. If lots of people want oranges, the system makes oranges more “expensive” in apples. This helps keep everything balanced and fair for everyone.