Cardano is a blockchain platform built on top of peer-reviewed research and evidence-based methods. ADA is Cardano’s native cryptocurrency. Cardano is currently the largest blockchain implementation to use Proof-of-Stake as a consensus mechanism.

What is Cardano (ADA)?

Cardano is a blockchain platform that was developed with methods based on peer-reviewed research. It employs innovative technologies that enable unrivaled security.

Cardano boasts its foundation on the scientific method – emphasizing that evidence-based methods have been used in the development work, pioneering in building an open and inclusive blockchain. In this article, we will explore this promising blockchain technology and its native cryptocurrency, ADA, following the outline below:

- What sets Cardano apart?

- History of Cardano

- The Ouroboros protocol

- How does Cardano’s Proof-of-Stake protocol work?

- How to buy Ada?

- How to delegate Ada and win rewards?

- Conclusion

What sets Cardano apart?

According to their website, Cardano follows a rigorous approach in its work in order to produce an unparalleled level of assurance. Their protocol implementations and platform integrations are first mathematically modeled and researched before being handled by development.

Cardano is really assertive in emphasizing their reliance on peer-reviewed research in their work. This in turn is one of the reasons for Cardano’s popularity and rather large following.

Another interesting characteristic of Cardano is that it truly incentivises participation from its users. Ada holders have the ability to vote on proposals for enhancements (and even submit their own proposals) to help determine the direction of new developments or upgrades. The rationale is that this active participation and democratic approach greatly contributes to the longevity, health and growth of the system.

Cardano implements a proof-of-stake consensus mechanism. The proof-of-stake protocol it uses is known as Ouroboros. This protocol is claimed to provide (and even improve!) the security guarantees of the proof-of-work protocol, but only at a fraction of the energy consumption and cost. More on Ouroboros and the proof-of-stake protocol later in this article.

The Cardano blockchain platform’s native currency is ADA, just as we saw ETHER (ETH) being the native coin of the Ethereum blockchain.

History of Cardano

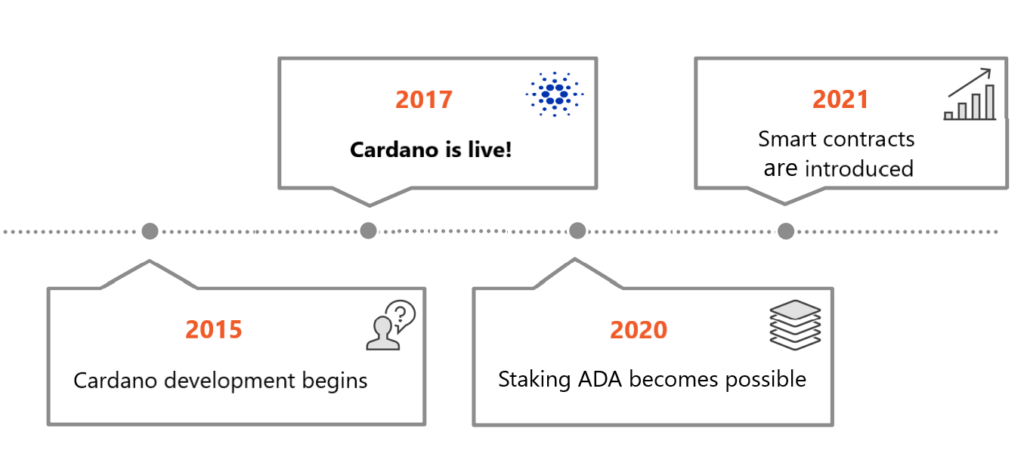

The Cardano platform was created by Charles Hoskinson in 2015. That’s the year Cardano’s development began, but the platform was launched in 2017. It’s interesting to note that Charles Hoskinson was a co-founder of Ethereum.

Hoskinson reportedly had a disagreement with Ethereum’s founder Vitalik Bunderik, regarding the status of the Ethereum foundation. Charles wanted it to be for-profit and attract investors, whereas Vitalik insisted that the Ethereum platform remained as a non-profit one. As a result of this disagreement, he was asked to leave Ethereum in a meeting with Vitalik and the rest of the Ethereum co-founders in Switzerland in 2014.

Cardano was named after the 16th century Italian mathematician Gerolamo Cardano. Its native currency ADA in turn was named after Ada Lovelace, the famous English mathematician.

The currency Ada has a sub-unit called Lovelace, and 1 ADA = 1,000,000 Lovelaces.

There are three partners involved in the Cardano story: the Cardano foundation, IOHK and EMURGO. The roles of each will be briefly explored below.

The Cardano Foundation is the body that owns the Cardano brand. It serves as its legal custodian and it’s the entity that oversees the development and advancement of the Cardano ecosystem. The Foundation’s activities involve promoting Cardano, growing its adoption and building new partnerships.

EMURGO is responsible for creating commercial opportunities for Cardano, and helping businesses embrace the platform. EMURGO is regarded as the for-profit arm of Cardano.

IOHK was founded by Charles Hoskinson and Jeremy Wood, as a technology company that specializes in the development of blockchains and cryptocurrencies. IOHK is basically entrusted with the development work for Cardano, and it is contracted to build and maintain it. It can be viewed as the engineering arm of the platform.

The Ouroboros protocol

Ouroboros is actually a term that is used to depict an ancient symbol of a snake or a dragon eating its own tail. According to its mythical meaning, the symbol represents the infinity of time that flows back to itself. This name Ouroboros was chosen by founder Charles Hoskinson for Cardano’s proof-of-stake protocol in order to symbolize the possibility of infinite scale of the blockchain.

Ouroboros uses cryptography and some other mathematical concepts like combinatorics and mathematical game theory to build a robust protocol with strong guarantees on performance and integrity.

The promise of Ouroboros is that it will enable Cardano to gracefully scale and meet increasing global requirements, without compromising security at all. Furthermore, Ouroboros is claimed to be a very environmentally-friendly technology.

How does Cardano’s Proof-of-stake work?

Proof of stake is a consensus mechanism that relies on the amount of stake (amount of cryptocurrency) held in a system in order to choose which node will build the next block. The idea is that This is different from a proof-of-work protocol, where nodes (also known as miners) need to compete in solving a mathematical problem. The first node to successfully complete the task builds the next block in the proof-of-work protocol and gets a reward for doing so.

In the proof-of-stake protocol, no mathematical task needs to be solved, hence no extensive amounts of energy and computing power need to be spent.

The way proof-of-stake works instead is that stake pools are formed which hold in a single entity the combined stake of various participants. A stake pool is nothing more than a collection of reliable servers (computers), to which any ADA holder can decide to delegate their stake. After delegating their ADA as stake to a stake pool, the ADA holders receive rewards whenever that stake pool is chosen to create a new block.. The reward comes because the delegated ADA by the holder has increased the ADA stake of the stake-pool, hence the holder is eligible for the portion of the reward.

It is important to note that the delegated ADA is not blocked nor held by the stake pool in any way. It is completely at the disposal of its owner to spend in any way he or she pleases. More on how you can delegate your ADA to a stake pool and win rewards is available further in this post.

Back to stake pools, which are at the heart of the proof-of-stake algorithm. These collections – or pools – of reliable computers need to commit to remain online 24/7 and run the Ouroboros protocol, by processing Cardano transactions and producing new blocks.

Among the available stake pools (more than 2500 different Cardano stake pools exist), the winner stake pool is chosen based on a combination of a random selection and the amount of stake held in the pool. Consequently, the bigger the amount of stake a pool has, the greater the chance it is selected to produce a new block.

You might ask yourself, doesn’t this mean that one or a few very large pools who hold the most ADA currency can eventually gain control of the system? Well, in order to prevent this situation, Cardano has put in place an incentive system that discourages delegation of ADA to pools that already control a large amount of it.

Additionally, Cardano implements randomness in the selection process of the stake-pool that will form the next block. So the algorithm doesn’t just pick the stake pool controlling the highest amount of ADA, but adds a random number in the selection process as well.

| Cardano at a glance: | |

| Cryptocurrency ticker: | ADA |

| Creation date: | 2017 |

| Creator: | Charles Hoskinson |

| Consensus mechanism: | Proof-of-Stake |

| Current price: | See live prices here |

| Maximum Supply: | 45 billion |

| Hash algorithm used: | None, since Proof-of-Work is not used |

How to buy ADA?

ADA can be purchased on any available cryptocurrency exchange, just like other cryptocurrencies. Take your time to explore cryptocurrency exchanges that support ADA.

Also, it is highly recommended that you keep your ADA on a cryptocurrency wallet. You can have a look at our review for the market-leading hardware crypto wallets for a holistic overview of their characteristics and security considerations.

How to delegate ADA and win rewards?

As already explained earlier in this article, if you own ADA you might opt to delegate it to a stake pool. Stake pools are online 24/7 on your behalf, and if you delegate your ADA to a pool, you are eligible to win a portion of the reward for the new block(s) created by that stake pool.

Remember that delegating your ADA to a stake pool does not mean you send them your ADA. You are still in complete control of it, your ADA is not at risk, and it’s neither locked up. You can still choose to spend your ADA in any way you please.

Also, rest assured that the stake pools do not control the process of sharing the rewards among the participants in the stake pool. This is automatically done by the Cardano protocol, so any rewards earned by delegating your ADA to the pool are automatically distributed by the protocol itself. Delegating your ADA is secure and does not put it at risk.

Conclusion

Cardano is a blockchain technology that has based its development and continuous evolution on peer-reviewed research. According to its founders, Cardano implements scientific rigor and mathematical modeling and research in producing a blockchain with unparalleled security.

Cardano implements a proof-of-stake protocol, called Ouroboros. At the heart of this protocol are stake pools – reliable computers who commit to run the Ouroboros protocol 24/7.

The creation of a new block in Cardano’s blockchain is entrusted to a selected stake pool. An algorithm does this selection by taking into account randomness, as well as the amount of ADA the stake pools control. The more ADA a stake pool controls, the higher its chances to be selected by the protocol to create a new block and thus win rewards.

ADA holders can also choose to delegate their ADA to a stake pool, so that the amount of cryptocurrency the stake pool holds increases. This in turn increases the pool’s chances to be selected by the Ouroboros protocol to create a new block. The reward of creating a new block is then distributed by the protocol among the delegators in that stake pool. Staking ADA to a stake pool is risk free, as you aren’t giving control of your assets in any way. The ADA holder is free to spend their ADA at any time as the assets are not locked and controlled by the stake pool.

Frequently Asked Questions:

When was Cardano created?

Cardano’s development started in 2015, and the platform officially launched in 2017.

What consensus mechanism does Cardano implement?

Cardano implements the proof-of-stake consensus mechanism.

What is ADA delegation?

ADA delegation is the process of a holder delegating his or her ADA to a stake pool in order to win rewards when that stake pool is chosen to create a new cardano block.

Does ADA delegation lock away the assets from the owner?

No, the ADA owner remains in complete ownership and control of the delegated ADA, and may choose to spend it in any way they please.