We’ve witnessed Bitcoin’s price climb to new records in this first quarter of 2024. Let’s delve into an analysis of the possible reasons behind the latest price increase.

What is influencing Bitcoin’s record price in 2024?

We’ve covered Bitcoin and the technology specifics behind it in our academy article on this popular cryptocurrency. And we’ve witnessed its price climbing to new records in this first quarter of 2024. But at MrCryptoz, we do not take things for granted, and strive to understand the cryptocurrencies state of affairs by providing analysis of what might be the reasons behind the latest price increase.

Key Takeaways:

- The US SEC’s approval of Bitcoin ETFs in early January 2024 positively impacted Bitcoin’s price.

- The UK’s FCA decision to allow cryptoasset-backed Exchange Traded Notes under strict regulations also contributed to price dynamics.

- Bitcoin’s upcoming “halving,” which reduces the rate of new bitcoin creation, is believed to influence its price, though opinions vary.

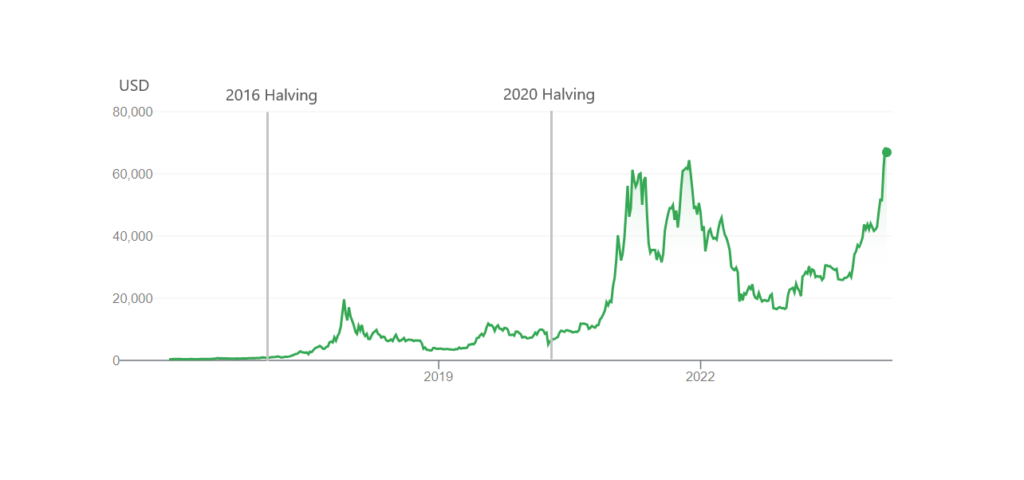

- Historical data from previous halvings show mixed results, making it difficult to directly link halvings to long-term price increases.

- Psychological factors, like FOMO (Fear of Missing Out), drive inexperienced investors to buy, potentially inflating prices during upward trends.

There is little arguing that US SEC’s approval of Bitcoin ETFs in early January this year had a positive impact on the coin’s price, driving it upwards. And around 2 months later, UK’s FCA also announced it would not object to Recognised Investment Exchanges (RIEs) creating cryptoasset-backed Exchange Traded Notes (cETNs), though under strict regulations.

Another aspect that is believed to somewhat influence Bitcoin’s price is its upcoming “halving”. The halving is a characteristic of Bitcoin’s blockchain code, which reduces the rate at which new bitcoins are created (Bitcoin has a limited supply capped at 21 million tokens).

The relationship between bitcoin’s halving and its price remains a contentious topic. Some argue that reduced supply should theoretically increase prices. Others maintain that any impact is already reflected in the current price – after all, it’s always been a known fact that Bitcoin’s halving occurs roughly every four years.

If we look at historical data from previous halvings that occurred in 2020 and 2016, we see mixed results. There were indeed some short-term price increases, but they were followed by varied performance, making it difficult to attribute price movements to halvings alone.

Apart from factual considerations like the above, it is argued that a major price pump for cryptocurrencies in general is the psychological FOMO (Fear of Missing Out), that mainly affects inexperienced investors. Seeing upward trends, they rush in buying fueled by the fear that they might be missing out on an opportunity for easy gains.

MrCryptoz will continue to analyze cryptocurrency prices and latest news. And remember, the world of cryptocurrencies can be like riding a rollercoaster with its ups and downs. It’s exciting but risky. Before you jump in, remember it’s not just about quick wins. Prices can change fast, and what goes up can come down. Always do your homework, know what you’re getting into, and never invest more than you can afford to lose. Stay safe and think long term.