XRP is the native cryptocurrency of XRP Ledger, which is an open-source, public blockchain intended to enable faster and cheaper payments.

What is XRP(Ripple) and How Does it Work?

XRP Ledger (XRPL) is a public, open-source blockchain technology designed for the fin-tech industry, and comes with XRP as its native cryptocurrency. The primary objective of the XRP Ledger is to make international payments easier, by facilitating faster and more affordable transactions. Read on to find more about this exciting cryptocurrency and blockchain solution!

- How does XRP work?

- History of XRP

- Notable Ripple/XRP achievements

- XRP Ledger’s consensus mechanism

- Criticism around XRP and Ripple

- Conclusion

How does XRP work?

Typically, cross-border transactions using the traditional or legacy financial systems (like SWIFT) take one to four business days to settle and incur higher fees.

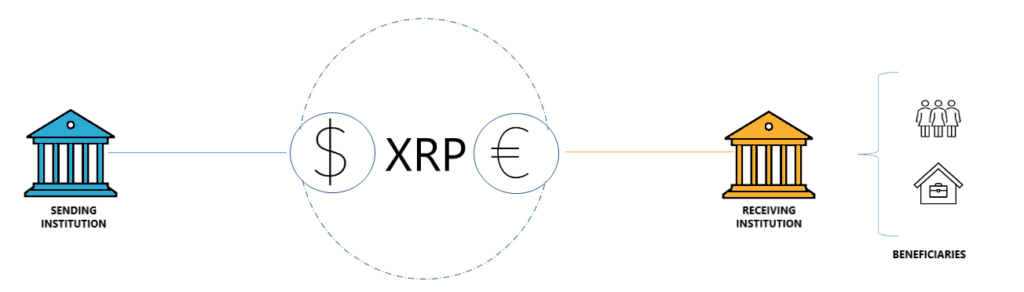

The XRP Ledger uses XRP as a bridging currency in order to settle payments of different currencies. A transaction using XRP is settled in a timeframe of between 3 to 5 seconds, at a much lower cost than the traditional methods currently in widespread use.

The way cross-currency payments in XRP Ledger take place is that they are able to use XRP as a bridging currency. For example, if you attempt to send USD from your account to an European account in EUR, the USD amount would first be converted to XRP, and then XRP would be converted to EUR on the receiver end. The conversion USD-XRP-EUR would take place only if doing so is cheaper than converting directly from USD to EUR. All payments in XRP Ledger are atomic, meaning that either the complete transaction executes in full, or no part of it executes at all in case of any error.

Ripple claims that XRP transactions on average cost 0.0002 USD per transaction, and they settle in the XRP Ledger in 3 to 5 seconds. The XRP Ledger operates 24/7, and is able to process 1500 transactions per second in a consistent manner. Because XRP Ledger does not employ proof-of-work, it is considered very environmentally friendly, 61.000 times more efficient than proof-of-work blockchains.

History of XRP

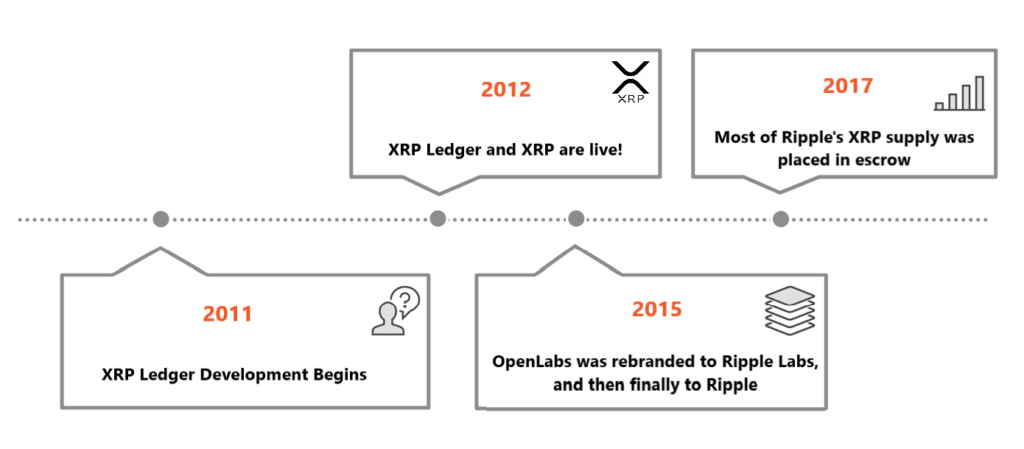

XRP Ledger was created in 2012 by Jed McCaleb , Arthur Britto and David Schwartz, along with its native cryptocurrency XRP. There is a maximum supply of 100 billion XRP, all of which has already been created. No more XRP will ever be issued.

To clarify the relationship between XRP and the Ripple company, we will delve slightly deeper in the historical timeline below.

In 2004, Ryan Fugger, a developer who had experience in working in a local exchange trading system

in Vancouver, built a decentralized payment platform known as RipplePay. RipplePay could facilitate peer-to-peer lending, without requiring the involvement of banks. In this regard, RipplePay’s decentralized payment platform preceded Bitcoin by some 4 years.

Independently, in 2011 Jed McCaleb , Arthur Britto and David Schwartz joined together in working on a new cryptocurrency, intending to eliminate some weaknesses of Bitcoin. They created a digital currency which instead of employing a consensus mechanism like the popular proof-of-work, had transactions verified by consensus formed from the members of the network.

Chirs Larsen joined them in 2012, after which the team approached Ryan Fugger. They wanted to use Fugger’s work and couple it with the newly developed digital currency, to which Fugger agreed. The result was the new company OpenCoin, which was rebranded to Ripple Labs in 2013. There was an additional rebranding in 2015, with the company changing its name to present day’s Ripple.

The creators of the XRP digital currency, Jed McCaleb and the others, donated 80 billion XRP to the Ripple company, with the other 20 billion being shared amongst the founders themselves.

Notable Ripple/XRP achievements

Undoubtedly, Ripple has caused waves and shocks in the payment industry, and its innovative solutions were impossible to ignore even by the banking giants and other goliaths of the financial industry. It is regarded as the first mainstream utilization of blockchain technology in the banking domain.

Towards the end of 2017, Ripple made headlines when American Express announced that they are looking to partner with this promising blockchain-based fintech start-up in order to provide faster and cheaper cross-border payments between the U.S. and UK.

But American Express is not the only high-profile partner of Ripple. British bank Santander UK also leverages Ripple for its One Pay FX mobile app, which enables instant or same day cross-border payments, with attractively low rates. Today, Santander’s One Pay FX operates in six countries and enables payments to more than 20 countries, effectively covering all the eurozone.

Ripple also boasts other success stories from partnerships with other financial industry actors operating worldwide. One notable partnership is established with South Korea’s Cross ENF, a fin-tech company that provides payment solutions to migrant workers and families of students studying abroad. By partnering with Ripple in 2018, Cross ENF actually became the first blockchain-based payment service in South Korea. Their app is aimed mainly at migrant workers in the country who seek to send money back to families home, at affordable rates. Working with Ripple, Cross ENF now serves real-time gross settlement payments with affordable fees to places like Sri Lanka, Philippines and Thailand.

XRP Ledger’s consensus mechanism

As mentioned previously, XRP uses a unique consensus mechanism, different from the more common proof-of-work and proof-of-stake. XRP works via validators, which are designated servers that must come to an agreement in order to approve XRP transactions. Ripple maintains what is known as a Unique Node List (UNL), which lists the recommended validators to be used for validations by the nodes that run the XRP ledger. This is a recommendation only, because each node has its own UNL, or the list of validators it has chosen to trust in order to reach consensus. The default UNL bundled in the software is actually Ripple’s recommended one, and it is rarely changed by the nodes. This has led to the criticism that Ripple is the entity controlling the choice of validators. However, Ripple maintains that they periodically update the list to include new validators that are run either by Ripple itself, or other partakers in the XRP community. According to the company, more than half of the current validators are from people or entities outside of Ripple, showcasing that Ripple actually does not have disproportionate, nor meaningful power on the XRP Ledger.

| XRP at a glance: | |

| Cryptocurrency ticker: | XRP |

| Creation date: | 2012 |

| Creators: | David Schwarz, Jed McCaleb, Arthur Britto |

| Consensus mechanism: | XRP Consensus Protocol |

| Current price: | See live prices here |

| Maximum Supply: | 100 billion |

Criticism around XRP and Ripple

XRP and Ripple haven’t been short of controversy or criticism. Among the most common ones are that XRP isn’t truly decentralized, that more XRP can be created at any time, and that Ripple is able to control the market price of XRP. Let’s delve a bit deeper into each.

Is XRP really decentralized?

One of the main characteristics of cryptocurrencies is that they are of a decentralized nature, meaning they are not controlled nor governed by a central institution or government body. Being decentralized means that there is no center of control or governance.

The controversy with XRP lies in the fact that the XRP ledger does not employ the well-known proof-of-work or proof-of-stake consensus mechanisms seen in most other cryptocurrencies. Transactions in the XRP Ledger (XRPL) are verified by a network of validators, several of which belong to the Ripple company itself. The other validators in the network are from the XRP community. Ripple has gone at length in a blog post by David Schwarz, explaining how they see XRP as being even more decentralized than Bitcoin and Ethereum.

Can more XRP be created?

The maximum supply of XRP is 100 billion, all of which has already been created and distributed among Ripple and the founders, as explained above. The controversy is that there’s no true limit in the code that makes it impossible to create additional coins, and that Ripple can decide to do so at any time. A reaction to these claims came again from Ripple’s David Schwarz, who shared a letter explaining how there is no way to create additional XRP.

I know I said I wouldn’t reply, but this is ridiculous. pic.twitter.com/mbhe1Ec5j4

— 𝙳𝚊𝚟𝚒𝚍 𝚂𝚌𝚑𝚠𝚊𝚛𝚝𝚣 (@JoelKatz) November 26, 2017

They maintain also that the amount of XRP can only be decreased, because when using XRP in transactions, a fee is “burned” for every transaction. This “burnt” XRP amount can never be retrieved in any way. It has already slightly lowered the XRP total supply to something more than 99.99 billion at the time of writing. So with its usage and application increasing, the actual supply of XRP decreases, which is expected to have a positive effect on the cryptocurrency price in the long term.

Does Ripple Control The Market Price Of XRP?

Ripple has the majority of XRP available, after 80% of all the supply was donated to the company by its creators (who are founders of Ripple as well). However, Ripple does not operate with their XRP amount at whim. They have actually locked 55 billion of XRP into an escrow account (in December 2017, after the decision for the escrow account was announced in May 2017). If you haven’t heard of an escrow account before, know that it is a type of account which locks in the available funds until certain conditions are met. The funds are released and can be used only after these conditions are fulfilled. They are typically used in some sort of merchant scenarios, where the seller would have to deliver the agreed goods/services, before he can access the money put by the buyer into the escrow account. If the seller fails to fulfill the conditions, the buyer can get their money back.

Ripple has also committed not to flood the market by overselling to exchanges. Additionally, they transparently publish quarterly reports on their sales and escrow activity, the last of which can be found here.

Conclusion

XRP Ledger is an open-source, public blockchain that employs a type of consensus mechanism that makes it greener and more energy-efficient than other proof-of-work blockchains. Its native cryptocurrency is XRP, which has a maximum supply of 100 billion, all of which has already been created. XRP Ledger was created in 2012 by David Schwartz, Jed McCaleb, and Arthur Britto, who started with the development earlier in 2011 after being fascinated by Bitcoin and looking to improve some of its weaknesses. 80 billion XRP was donated by the developers to Ripple, a company also owned and run by some of the same developers. Most of this XRP is put on an escrow account, with limited amounts being released to be used by fin-tech clients who use XRP Ledger and XRP to facilitate payments in fast, affordable and scalable ways. XRP Ledger was specifically designed with the payment industry in mind, and facilitates transaction settling in 3-5 seconds. The blockchain is able to steadily process 1500 transactions per second. There are notable banks and other financial institutions who already use the XRP Ledger and XRP to provide innovative payment services and applications, at a fraction of the cost of more traditional systems.

XRP facilitates cross-border payments in different currencies by using XRP as a bridging currency. So in order to send USD funds to a MXN account, the ledger would first convert USD to XRP, and then XRP to MXN, if doing so is cheaper than directly converting USD-MXN.

Frequently Asked Questions:

When was XRP created?

Development of XRP Ledger and the XRP cryptocurrency began in 2011, and the solution was live in 2012.

Can any more XRP be created?

No. The maximum supply of XRP is 100 billion, all of which has already been created.

What is the XRP Ledger primarily used for?

The XRP Ledger was specifically designed with the payments industry in mind, and today it is used by notable banks and financial institutions worldwide to provide fast and affordable payment services.

Are Ripple and XRP the same?

No. XRP Ledger and its native cryptocurrency XRP is a public, open-source blockchain project, whereas Ripple is a private company which holds the vast majority of XRP. 80% of all the XRP created was donated by the XRP developers to the Ripple company.