Ethereum is a blockchain platform on top of which decentralised applications can be built. Ethereum’s native cryptocurrency, Ether, is second only to Bitcoin in market capitalisation.

What Is Ethereum?

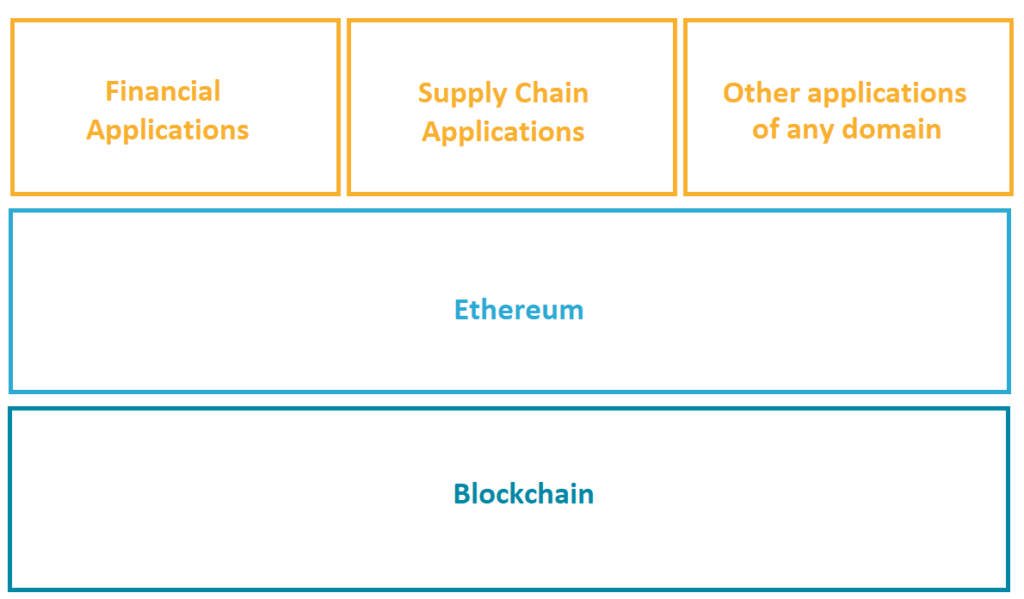

After Bitcoin was created, Blockchain as a technology became very popular and many new initiatives to build blockchain-based applications emerged. However, each of them had to create their own blockchain, often from scratch. This made the entry barrier for new building new applications very high, as each had to develop the blockchain backbone from the ground up.

This is the problem that Ethereum tries to solve. In this article, we will examine the Ethereum blockchain and its promise of being the bedrock for building decentralised applications.

- Ethereum overview

- History of Ethereum

- Ethereum’s transition to proof-of-stake

- Ethereum wallets

- Where to buy Ether

- Is Ethereum harmful to the environment?

- Conclusion

Ethereum overview

Ethereum is a blockchain-based platform on top of which different applications can be built. Anyone with an idea on how to utilise the power of blockchain to solve a problem, does not need to build the distributed ledger (blockchain) from scratch. They can use Ethereum instead, as a platform on top of which to build their application. And that application can be from any domain, not just the financial one. Applications for blockchain-based voting, for supply chain, for identity document management – just about anything -, can be built with Ethereum.

All this is possible because Ethereum is a Turing-complete language. Turing complete means that it is possible to build any type of application with such a language, because all programming constructs are available in it.

So while Ethereum is just a platform for building distributed applications on top of a blockchain, it also has its own cryptocurrency. Ethereum’s cryptocurrency is known as Ether, and it acts just like a normal cryptocurrency with which you can pay for goods and services. However, Ether is also used as a payment method for applications that are built on top of Ethereum.

So, if you want to build a new decentralised application that uses blockchain technology, you can build that application on top of the Ethereum platform, without needing to build a decentralised system from scratch. And in order to run this application, you pay small fees to Ethereum in Ether. So in a sense, Ether can be described as the fuel that powers your Ethereum-based application, much like gas powers a vehicle to be used as a means of transport.

History of Ethereum

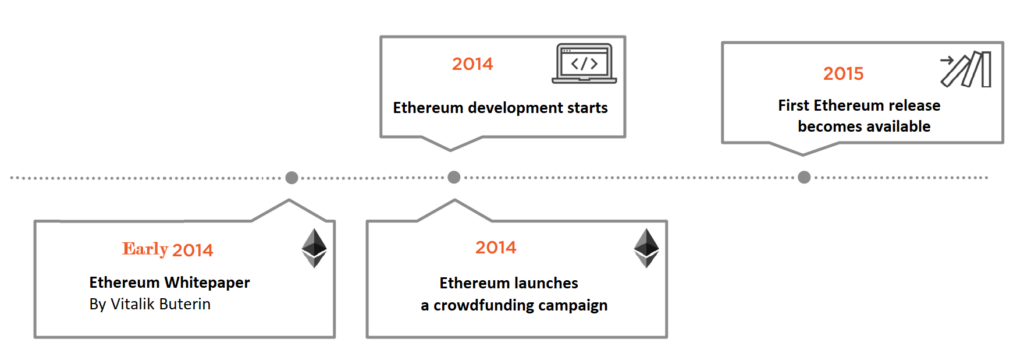

When it comes to the history of Ethereum, we should note that it was designed in 2014. Unlike Bitcoin’s Satoshi Nakamoto, Ethereum’s developer has revealed his true identity, and that is Vitalik Buterin. He published a white paper on Ethereum in 2014, and later that year the Ethereum development also began.

In the same year of 2014, the Ethereum development team launched a crowdfunding campaign, in order to raise funds for Ethereum’s development. The campaign started on July 22, 2014 and the team managed to sell more than 7 million Ether in the first 12 hours alone.

For fourteen days, Ether was sold at the price of 2,000 ether per bitcoin. Ether was rising in value as the successful campaign was progressing, ultimately reaching a final rate of 1,337 Ether per Bitcoin. In the September 2014 prices, this means that one ether was worth 0.0007479 bitcoin or about 30 cents. Today, Ether is the second largest cryptocurrency in terms of volume.

There exist several types of Ethereum networks. The first type are the public networks which are open for anyone to access. A public Ethereum network is permissionless, and there are no restrictions for joining it. A consortium network is another type of an Ethereum network, and this is usually a network consisting of a group of institutions or organizations. In this case, access to the Ethereum network is restricted only to the members of that group. The final network type is a private Ethereum network, and it’s one that is created only by a single institution. Access to it is restricted only to that institution, and such a type of network is typically used to test Ethereum applications prior to their release either on a consortium network or a public one.

Ethereum’s founder, Vitalik Buterin came up with the name Ethereum after looking through a list of science fiction elements on Wikipedia. He liked Ethereum because it featured the word ether, referring to the theoretical invisible medium that permeates the universe and permits light to travel. This was convenient, as he envisioned the Ethereum platform as the underlying, undetectable medium for the applications that operate on top of it.

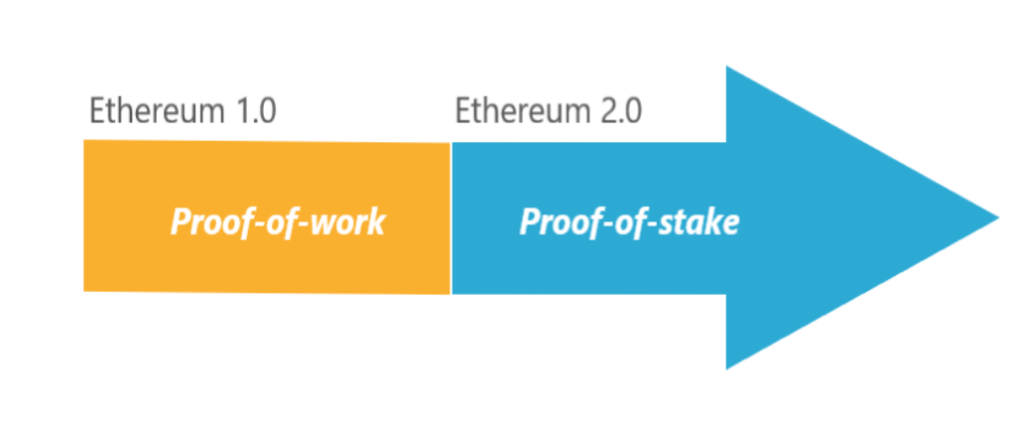

Ethereum’s transition to proof-of-stake

Moving from proof-of-work to a proof-of-stake consensus mechanism has been part of Ethereum’s plans for its Ethereum 2.0 version. The main goal of this upgrade is to increase throughput of Ethereum transactions. The way to achieve this is to create 64 parallel blockchains which then share a common master blockchain (also known as the Beacon chain). The Beacon chain will operate in the proof-of-stake mechanism to achieve consensus in all the underlying blockchains. This architecture is referred to as “sharding”. Anyone trying to deliberately tamper with any constituent chain would need to tamper with the common blockchain. This malicious tampering would cause the hacker to loose their stake, potentially costing them more than what they could actually gain from the fraud.

The Ethereum 2.0 version is intended to be launched in three different phases or increments.

Phase 0 was launched on December 1st, 2020, and featured the newly created Beacon Chain. As we already mentioned, this chain is intended to act as the central coordinator and consensus hub for Ethereum 2.0.

Phase 1 is intended to merge the Beacon chain with the existing Ethereum network. This is planned to take place in the third quarter of 2022. In this phase, the current proof-of-work consensus mechanism would be switched to the proof-of-stake one.

Finally, phase 2 is planned to be released in 2023. It will introduce “sharding” to Ethereum, by spreading the load of the network across 64 new chains which will then be coordinated by the main Beacon chain.

A word on the proof-of-stake consensus mechanism

Proof-of-stake is a type of consensus mechanism where a participant stakes a specific amount of its own cryptocurrency in order to participate in the process of creating new blocks and validating existing ones.

Validators are then selected at random for creating blocks, and they are also responsible for validating blocks they don’t create. Their ETH stake is utilized in incentivising and motivating reliable behavior. Validators lose a part of their stake if they fail to validate blocks (by going offline, for example), or even all of it if they perform malicious fraud.

There are several benefits to the proof-of-stake consensus mechanism. First and foremost, the proof-of-stake mechanism comes with improved energy efficiency, as less energy is needed to mine blocks when compared to the existing proof-of-work consensus mechanism.

Secondly, the barrier to entry is reduced, as a participant doesn’t have to invest a lot in powerful and expensive hardware in order to create new blocks and thus earn the rewards. Consequently, with the lowered barrier to entry, proof-of-stake is expected to contribute to more nodes in the network. This in turn would further reduce the risk of centralisation.

There are also some disadvantages to this consensus mechanism. The most important one is that proof-of-stake is still a rather novel mechanism still in its infancy, as opposed to proof-of-work which is already an established consensus mechanism that has stood the test of time. Additionally, some critics point out that in a proof-of-stake model, participants who own large amounts of Ether would be in greater advantage to be selected as validators. Some even go as far as pointing out that the whole network could be more easily hacked. If a group of participants could come to own the majority, or 51% of the whole Ether at stake, they would then be able to validate blocks that have been previously changed to their benefit. However, for someone that owns such a large amount of the cryptocurrency, tampering with the blockchain would make no financial sense, as it would render it unreliable and thus their Ether would eventually lose its value.

| Ethereum at a glance: | |

| Cryptocurrency ticker: | ETH |

| Creation date: | 2015 |

| Creator: | Vitalik Buterin |

| Consensus mechanism: | Proof-of-Work, planning to transition to Proof-of-Stake |

| Current price: | See live prices here |

| Maximum Supply: | Not limited |

| Hash algorithm used: | KECCAK-256 |

Ethereum wallets

An Ethereum wallet is used in connection with an Ethereum account, so let’s have a look at that as well. An Ethereum account is not like a bank account for which you would need a bank to open it for you. Ethereum accounts are created by a user, and a user can create more than one account for himself at any time. An Ethereum account is just a long random number, and the probability that two users generate the same account number is very very low. While bank accounts are typically used only for conducting payments, Ethereum accounts can additionally be used to access Ethereum applications, apart from being used for payments.

As with other cryptocurrency wallets, once access to an Ethereum account is lost by losing or forgetting your wallet password, you cannot restore your account. With a bank account, you’d simply ask your bank to do so, and after providing some identification and additional information, they would restore the account for you. This is not the case with an Ethereum account however, so users should be very mindful to safeguard their wallet passwords. On the other hand, an Ethereum account can’t be blocked or deleted, whereas a bank account can certainly be blocked without your consent or even knowledge.

The Ethereum wallet generates a private key when you establish an Ethereum account, and the private key is basically a lengthy random number. It needs to be used to sign transactions sent from your wallet, and it should be kept private because anyone who has access to it, has access to your account and can thus make new transactions or send funds to other accounts.

Alongside the private key, wallets also generate an address and a public key. This public key is needed to confirm that a transaction originated from the owner of the private key. When you create a transaction, it is first signed by the wallet using its private key, after which it is sent to the blockchain, where anyone can verify it. Verification is done via the public key and the address of the account. So the owner signs a transaction with his private key, whereas anyone else can verify that transaction by means of the public key.

Where to buy Ether?

Ether can be bought at numerous exchanges, where it can be obtained against a payment in dollars, euros or even using Bitcoin or some other cryptocurrency. An alternative way to obtain Ether is by mining it. Mining Ethereum means becoming a peer in the Ethereum infrastructure, where you would provide your computational resources to the Ethereum network, by competing to create new Ethereum blocks and validate existing ones.

Like Bitcoin, Ethereum also currently uses the proof-of-work consensus mechanism. Proof-of-work requires a cryptographic hash puzzle to be completed by the nodes trying to add a new block to the blockchain. The fastest node to complete the puzzle is the winner and adds the new block. The winning node thus earns a reward, which is usually given in the native cryptocurrency of the blockchain (Ether in the case of Ethereum).

However, as mentioned above, Ethereum is transitioning into a proof-of-stake consensus mechanism. Under proof-of-stake, a node would need to stake its Ether before being able to create a new node in the blockchain.

Is Ethereum harmful to the environment?

Mining Ethereum under the proof-of-work consensus mechanism is computationally expensive, as it requires miners to solve complex cryptographic puzzles that eat up electricity in order to create new blocks. Although Ethereum mining is less expensive than Bitcoin mining, Ethereum has also been criticized for its environmental impact. Ethereum proponents are quick to point out that once Ethereum launches its 2.0 version, the energy consumption will be substantially decreased. The decrease will be the result of validators no longer being required to solve complex, energy-consuming mathematical puzzles as in the proof-of-work mechanism.

Conclusion

Ethereum is arguably the second most popular blockchain implementation after Bitcoin. Ethereum made waves since its very first release in 2014, due to its promise of being the blockchain foundation for any decentralized application, from any industry, that wants to use the benefits and characteristics of a blockchain technology. Besides being the foundation on top of which different decentralized applications can be built, Ethereum also has its own native cryptocurrency, the Ether. Ether is the second largest cryptocurrency by market capitalization after Bitcoin.

Although Ethereum initially employs the proof-of-work protocol as its consensus mechanism, it plans to transition to proof-of-stake with Ethereum 2.0.

Frequently Asked Questions:

When was Ethereum created?

Ethereum was created in 2015, following a white paper by its founder Vitalik Buterin which was published in 2014.

Why is Ethereum so popular?

Ethereum is a blockchain platform that can serve as a foundation for any type of decentralized application that wants to use the benefits of blockchain technology, without needing to build a custom blockchain from scratch. This is one of the main reasons for Ethereum’s popularity.

When will Ethereum transition to a proof-of-stake consensus mechanism?

According to the Ethereum website, the transition to the proof-of-stake consensus mechanism is expected to take place around Q3/Q4 of 2022.